UPDATED: SEPTEMBER 05, 2023 | 1 MIN READ

Health insurance is a crucial part of our health. It’s necessary to prevent financial ruin and to provide access to care. Pennsylvania insurance plans are important because they help people with limited or no resources pay for medical bills and treatment. They also provide a safety net when unexpected events happen.

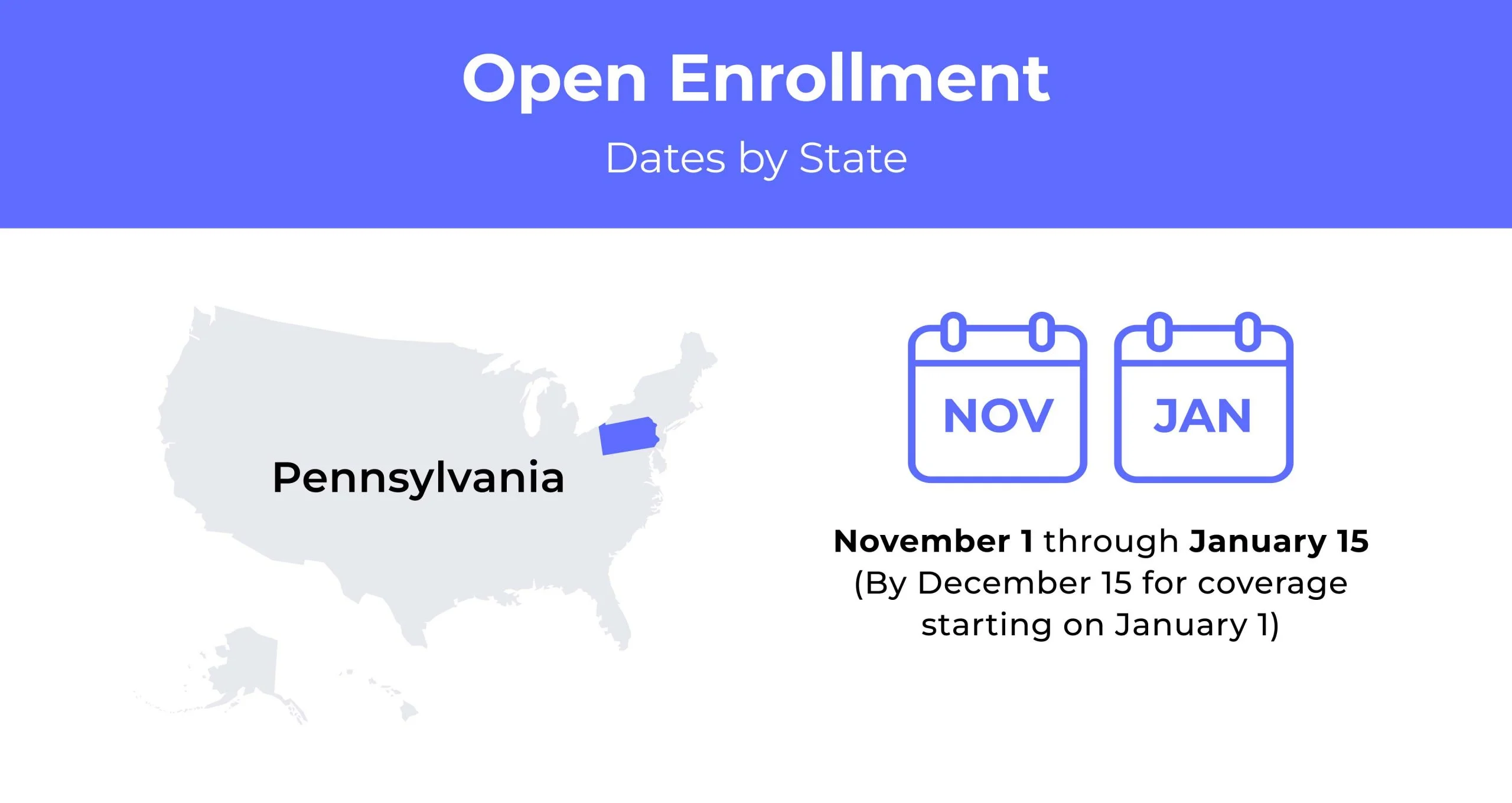

Pennsylvania Open Enrollment dates for health insurance

Pennsylvania’s Open Enrollment period for health insurance runs from November 1st to January 15th each year.

Pennsylvania health insurance demographics

Some insurers use age, gender, ethnicity, occupation, location, and education to determine rates. Other companies use only one or two factors.

Still, others use a combination of factors to determine rates. This means that there are many ways in which an insurer can charge people more or less.

- Average Household Income: The median household income in Pennsylvania is $63,627. This is slightly less than the United States median household income of $64,994.

- Median Age Range: The median age of Pennsylvania residents is 40.6.

- Education: More than 91% of Pennsylvania residents have graduated high school, with 32.3% having college degrees. The state has about 4.9% of residents working through college.

What type of health insurance Marketplace does Pennsylvania have?

Pennsylvania’s healthcare Marketplace is called Pennie. It has been created to help people get affordable health and dental coverage with financial assistance. The website connects consumers and providers to find the best plans for their needs at the best price.

How many people are insured through the Pennsylvania health insurance marketplace?

During the Open Enrollment Period of 2022 coverage, 374,776 enrolled in health plans.

Did Pennsylvania implement the ACA’s Medicaid expansion?

The Affordable Care Act was signed into law in 2010. Pennsylvania was one of the first states to expand Medicaid. In 2015, Pennsylvania adopted Medicaid expansion under the ACA.

When can you purchase ACA health insurance in Pennsylvania?

The enrollment period for 2022 health coverage ran from November 1, 2021, until January 15, 2022.

Residents who go through a ‘qualifying life event’ can also purchase health insurance up to 60 days after the event occurs. A qualifying life event can include:

- Marriage

- Divorce

- Birth

- Adoption

- Loss of employer-provided coverage

Types of ACA plans in Pennsylvania

ACA plans are health insurance plans that are available for individuals who do not have access to affordable coverage. The plans also apply to residents who have been denied coverage by their employer or do not have access to affordable coverage.

In Pennsylvania, the plans are either bronze, silver, or gold.

What carriers offer ACA health insurance in Pennsylvania?

Thirteen insurers offer coverage in Pennsylvania. Although some of them share parent companies. The thirteen insurers are:

- Capital Advantage Assurance

- Geisinger Health Plan

- Geisinger Quality Options

- Highmark, Inc.

- Highmark Benefits Group

- Highmark Coverage Advantage

- Keystone Health Plan East (Independence Blue Cross HMO)

- QCC Insurance Company (Independence Blue Cross PPO)

- UPMC Health Coverage

- UPMC Health Options

- PA Health and Wellness

- Oscar Health

- Cigna

How much does health insurance cost in Pennsylvania?

There are a lot of factors that determine how much health insurance will cost you. This includes your age, gender, marital status, and the state that you live in.

Based on a Silver plan, Pennsylvania residents expect to pay $622 per person monthly.

Cheapest health insurance by metal tier in Pennsylvania

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum-Out-of-Pocket |

|---|---|---|---|---|

| Bronze | UPMC Advantage Bronze | $225 | $6,700 | $8,700 |

| Silver | UPMC VirtualCare Silver | $315 | $4,500 | $8,700 |

| Gold | UPMC Advantage Gold HSA | $280 | $3,100 | $4,000 |

Cheapest health insurance by county

| County Name | Cheapest Plan | Individual, Age 40 | Couple, Age 40 |

|---|---|---|---|

| Allegheny | UPMC VirtualCare Silver | $315 | $625 |

| Bucks | Ambetter Balanced Care 30 | $390 | $775 |

| Delaware | Ambetter Balanced Care 30 | $390 | $775 |

| Montgomery | Ambetter Balanced Care 30 | $390 | $775 |

| Philadelphia | Ambetter Balanced Care 30 | $390 | $775 |

Are health insurance subsidies available in Pennsylvania?

The ACA (Affordable Care Act) has helped many people afford health insurance. Providing subsidies to those who earn less than 400% of the federal poverty level.

However, many still struggle to pay their premiums and healthcare costs. In Pennsylvania, there are some health insurance subsidies available that may help you pay your premiums or medical bills.

The health insurance subsidies available in Pennsylvania include:

- Advanced premium tax credit (APTC)

- Cost-sharing reductions (CSR)

Can you purchase off-exchange health insurance coverage in Pennsylvania?

Off-exchange health insurance is a term applied to plans purchased directly from an insurance provider or through a broker. It is different from on-exchange health insurance, which is the option that most people are familiar with. Off-exchange health plans vary in cost and coverage. Generally, they offer more flexibility than on-exchange plans.

There are some options for purchasing off-exchange plans in Pennsylvania, but the plans offered may differ.

Can you purchase short-term health insurance in Pennsylvania?

Pennsylvania residents who require temporary health insurance coverage can purchase a short-term policy. These policies typically have coverage for up to a year, but the duration can be varied depending on the policyholder’s needs.

Health insurance options for low-income people in Pennsylvania

There are low-income people in Pennsylvania who struggle to find affordable health insurance.

The Affordable Care Act (ACA) has allowed people with low incomes to get affordable health insurance. The ACA offers different options for people who don’t qualify for Medicaid or the Children’s Health Insurance Program (CHIP).

The ACA has provided Pennsylvania residents with various options to help them find affordable health insurance coverage. They offer subsidies to help lower the cost of premiums, deductibles, and co-payments.

Both individuals and families can use these subsidies. Who then purchase individual or family coverage through the Marketplace.

What Medicare options are available in Pennsylvania?

There are four types of plans available in Pennsylvania’s Medicare Advantage program:

- Health maintenance organization (HMO)

- Preferred provider organization (PPO)

- Private fee-for-service (PFFS)

- Special needs plan (SNP)

Medicaid In Pennsylvania

Expanding Medicaid in Pennsylvania has allowed low-income individuals to benefit from health coverage. This is a new way to help those previously excluded by the Affordable Care Act.

Cheapest health insurance plans in Pennsylvania

Pennsylvania is a state that has a lot of different health insurance options. Some states have more choices than others, but finding the best plan for you and your family is still important.

Low out-of-pocket maximums

The cheapest health insurance plan with a low out-of-pocket maximum is my Priority Blue Flex EPO Bronze 3800 + Adult Dental and Vision plan, provided by Highmark BlueCross BlueShield.

High out-of-pocket maximums

A high out-of-pocket maximum means you will be responsible for more of the costs associated with your healthcare needs.

Pennsylvania’s cheapest health insurance plan with high out-of-pocket maximums is the UPMC Advantage Bronze $6,700/$0 – Partner Network Plan from UPMC Health Plan.

Cheapest plans with an HSA option

- Bronze: The Together Blue EPO Bronze 6900 HSA by Highmark BlueCross BlueShield.

- Silver: The Together Blue EPO Silver 3450 HSA by Highmark BlueCross BlueShield.

HMO/PPO/POS

- The cheapest HMO plan is the Ambetter Balanced Care 12 from Ambetter by PA Health and Wellness.

- The cheapest PPO plan is the UPMC Advantage Silver $0/$85 – Premium Network from UPMC Health Plan.

- The cheapest EPO plan is the Together Blue EPO Silver 3450 HSA from Highmark BlueCross BlueShield.

FAQs

How much is health insurance in PA per month?

The national average monthly cost of health insurance is $541.

Does PA have free healthcare?

In PA, Medicaid offers low-cost or free health insurance to low-income residents.

Is it mandatory to have health insurance in PA?

Pennsylvania has made insurance a requirement under the Affordable Care Act.

How do I qualify for Medicaid in PA?

To qualify for Medicaid in Pennsylvania, you must meet the eligibility criteria. These include being a U.S. national, citizen, permanent resident, or legal alien. You should also need financial assistance and have an income below the set limit for your family size. For a family of four, this is $36,908 (before taxes).

How long does it take to get approved for Medicaid in PA?

If you qualify for the Medical Assistance program, it is meant to take no more than about 45 days to get approval. Provided you supply all of the relevant documents.

How to shop affordable health insurance plans in Pennsylvania

Health insurance is a crucial part of our health. It is necessary to prevent financial ruin and to provide access to care. Insurance plans are important because they help people with limited or no resources pay for medical bills and treatment. They also provide a safety net when unexpected events happen. Shop plans that are available in your area today.

Related Content