UPDATED: SEPTEMBER 05, 2023 | 2 MIN READ

Health insurance is necessary for every person in Minnesota. Without health insurance, people could face high medical bills and other expenses that they can’t afford. Health insurance is a type of insurance coverage that protects against the costs of medical services. Health insurance can be either private or public, and it can cover both large and small expenses.

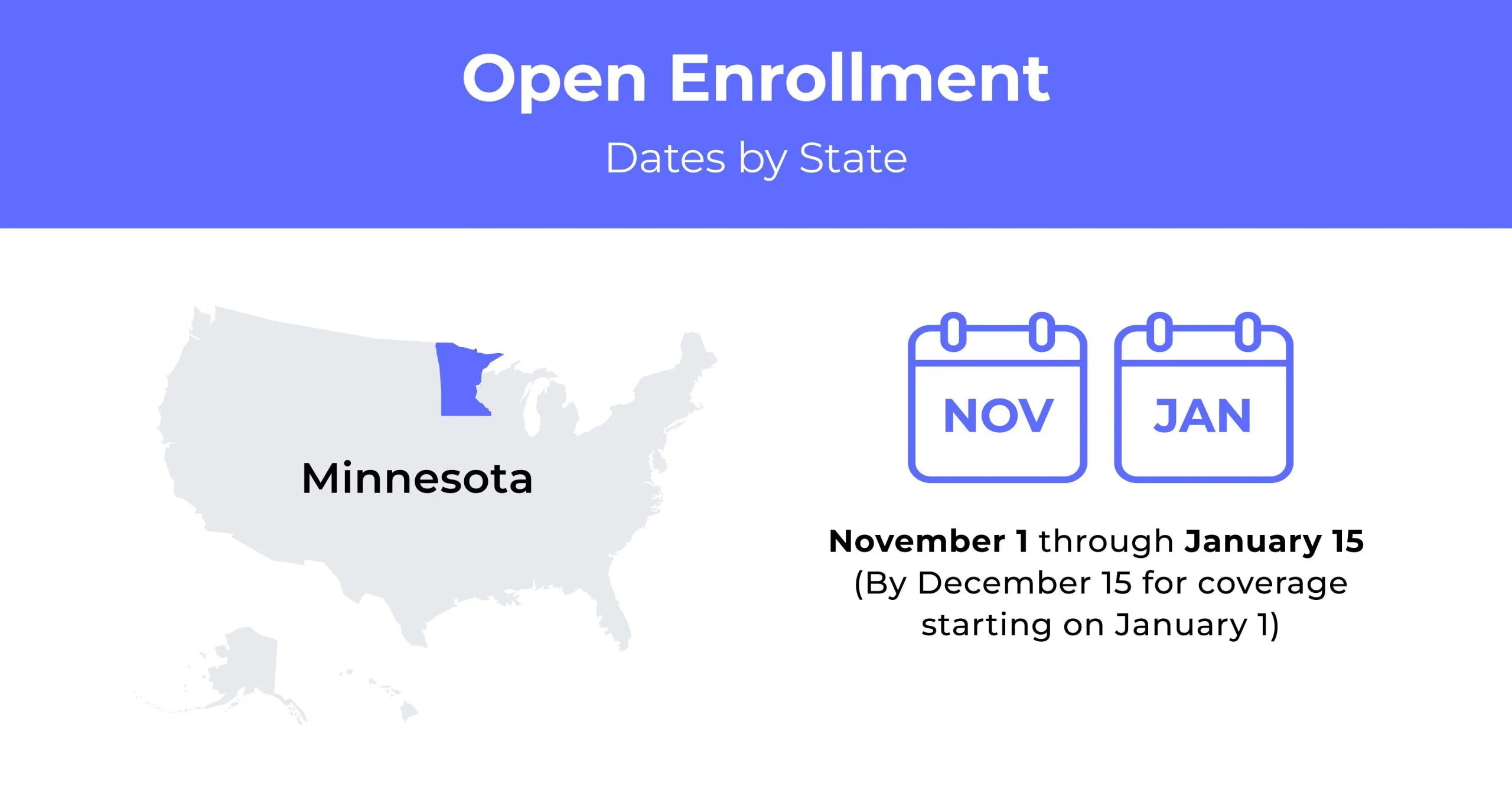

Minnesota Open Enrollment Dates For Health Insurance

Minnesota’s health insurance Open Enrollment period runs annually from November 1st to January 15th.

Minnesota Health Insurance Demographics

The insurance cost in any state depends on many factors. One such factor is demographics – an individual’s age, health status, gender, occupation, and more all have an effect. This information can then be used to determine insurance policy rates in any area.

- Average Household Income: The median household income in Minnesota is $73,382. This is above the United States median household income of $64,994.

- Median Age Range: The median age of Minnesota residents is 37.8.

- Education: More than 93% of Minnesota residents have graduated high school, with 36.8% having a college degree. The state has about 5.1% of residents currently working their way through college.

What Type Of Marketplace Does Minnesota Have?

The health insurance marketplace in Minnesota, called MNSure, is run by the state. Minnesota also has MinnesotaCare, a Basic Health Program that gives low-income people coverage. MinnesotaCare has no premium for people under 160% of the poverty level. As a result of the Basic Health Program, a lower than average number of Minnesotans qualify for premium subsidies and other Cost Sharing Reductions.

How many people are insured through the Minnesota health insurance marketplace?

In 2021, 134,969 people enrolled in insurance plans through Minnesota’s health insurance marketplace. This is an increase in the 117,520 people that enrolled in 2020.

Did Minnesota implement the ACA’s Medicaid expansion?

In February 2013, former Governor Mark Dayton signed “HF9”, a bill that expanded access to Minnesota’s Medicaid program under the ACA. The program was enacted to provide health care coverage for Minnesotans at or below 138% of the federal poverty level and applied for coverage under the state’s Medicaid program.

The program, open to all Minnesotans regardless of other income, is designed to provide subsidized insurance for people in a low-income bracket so they can more easily afford health care coverage.

When can you purchase ACA insurance in Minnesota?

Throughout the Open Enrollment Period, people have a chance to select or change their private health insurance plans. The time window for open enrollment varies from state to state, but in some states, it can be as short as a few weeks.

In Minnesota, this period is around nine weeks. The enrollment period for 2023 coverage is November 1, 2022, through January 15, 2023.

If you miss that window or decide you want coverage, you may have difficulty finding affordable coverage.

If you are a resident and experience a life event that qualifies for an exemption, you can buy health insurance up to 60 days after this event. Examples of qualifying life events include:

- Marriage

- Divorce

- Birth

- Adoption

- Loss of employer-provided coverage

Types of ACA Plans In Minnesota

There are several types of insurance plans to choose from here in Minnesota. Some are individual, and some are family-based. An individual plan is for one person, while health insurance for families is designed for more than one person simultaneously.

What carriers offer ACA health insurance in Minnesota?

Five insurance providers are offering ACA health insurance coverage in Minnesota. These five insurance companies are:

- Blue Plus

- Group Health

- Medica

- UCare

- Quartz

How Much Does Health Insurance Cost In Minnesota?

The cost of health insurance in Minnesota depends on how much you make, your age, and the type of plan you choose. Residents of Minnesota can expect to pay an average of $441 per person for a Silver plan.

Cheapest Health Insurance By Metal Tier In Minnesota

Minnesota offers three levels of individual and family health insurance. Below are the cheapest individual plan options for each tier.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Bronze | UCare M Health Fairview Bronze | $250 | $7,050 | $7,050 |

| Silver | Select $5,300 Plus Silver | $285 | $5,300 | $8,500 |

| Gold | Select $2,000 Gold with Co-Pay | $360 | $2,000 | $8,000 |

Cheapest Health Insurance By County

Health insurance costs can also vary by county. This table shows the cheapest individual plan available for Minnesota’s five largest counties.

| County Name | Cheapest Plan | Cheapest Plan Cost | Average Cost |

|---|---|---|---|

| Anoka | Select $5,300 Plus Silver | $285 | $325 |

| Dakota | Select $5,300 Plus Silver | $285 | $330 |

| Hennepin | Select $5,300 Plus Silver | $285 | $330 |

| Ramsey | Select $5,300 Plus Silver | $285 | $325 |

| Washington | Select $5,300 Plus Silver | $285 | $330 |

ARE Subsidies Available In Minnesota?

ARP affects subsidies, so information may only be accurate for a couple of months.

BHP program up to 200% of poverty level with contributions at 160% level.

Medical Assistance, MinnesotaCare, and CSR are available.

Can You Purchase Off-Exchange Insurance Coverage In Minnesota?

Health Insurance is available before on- and off-exchange with a wide variety of options available to residents of Minnesota; however, only financial assistance for health insurance is available through MNSure, Minnesota’s Health Insurance Exchange.

Can You Purchase Short-Term Insurance In Minnesota?

You can buy up to 6 months of non-renewable short-term health at a time in Minnesota. A further six months can be purchased after the term has lapsed. However, a limit of no more than 12 months of short-term health insurance can be bought in 18 months.

Health Coverage Options For Low-Income People In Minnesota

Minnesota has a Basic Health Program called MinnesotaCare, which provides low-cost comprehensive healthcare to residents up to 200% of the poverty level. No premium is payable for those under 160% of the poverty level.

Options include:

- MinnesotaCare

- Medical Assistance

- CSR

- Medicare

What Medicare Options Are Available In Minnesota?

Multiple types of Medicare Supplement policies are available in Minnesota:

- Basic

- Basic with riders

- Medicare SELECT

- Extended Basic

- Supplement Plan with 50 percent coverage

- Supplement Plan with 75 percent coverage

- Supplement Plan with 50 percent Part A deductible coverage

- Supplement Plan with $20 AND $50 Co-payment Medicare Part B coverage

- Supplement Plan with high deductible coverage

Medicaid In Minnesota

To be eligible for Minnesota Medicaid, you must be a resident of Minnesota, a U.S. national, citizen, permanent resident, or legal alien who needs health care/insurance assistance and passes the financial test.

- Pregnant, or

- Be responsible for a child 18 years of age or younger, or

- Blind, or

- Have a disability or a family member in your household with a disability, or

- Be 65 years of age or older.

Cheapest Health Insurance Plans In Minnesota

There are many different health insurance plans, and the cheapest is not necessarily the best.

There are a lot of factors that go into choosing a health insurance plan. Understanding what you’re getting into before you commit to a plan is essential.

Cheapest health plan in Minnesota with low out-of-pocket maximums

A Gold plan is a type of health insurance policy with the lowest out-of-pocket maximums. This means you will have to pay the least when you see a doctor or fill a prescription.

The cheapest Gold plan in Minnesota is the Select Gold I403 HSA from Quartz Health Plan MN Corporation.

Cheapest health plan in Minnesota with high out-of-pocket maximums

Many insurance companies offer low-cost plans with high out-of-pocket maximums. These plans let you choose how much of your income to spend on health expenses and are a good option for those who don’t need consistent treatment.

The cheapest Bronze plan in Minnesota is the UCare M Health Fairview Bronze.

Cheapest health plan in Minnesota with an HSA option

The most affordable Bronze plan with an HSA option in Minnesota is the UCare M Health Fairview Bronze HSA from UCare Minnesota.

Cheapest HMO/PPO/POS health insurance plans in Minnesota

- Minnesota’s cheapest HMO Silver plan is the UCare M Health Fairview Silver HSA from UCare Minnesota.

- Minnesota’s cheapest PPO Silver plan is the SmartCare $3,000 HSA Silver from HealthPartners.

- The cheapest POS Silver plan in Minnesota is the

FAQs

What’s the average cost of health insurance in MN?

In Minnesota, it is standard for residents to pay $392 per person for an individual medical health insurance plan.

Does Minnesota have free healthcare?

There are several subsidies to lower the cost of healthcare in Minnesota, some of which may reduce the price so that residents do not have to pay for their healthcare.

How do I get health insurance in MN?

There are many different ways to get health insurance in Minnesota. Still, most people purchase it through their employer or another source like the individual market or the exchange marketplaces set up by the Affordable Care Act (ACA).

Each type of plan has pros and cons, and you must know what you’re getting into before you sign up. Some individuals also choose to self-fund health insurance by purchasing it directly, through a private company, or from a broker that offers individual policies. There are pros and cons of this option as well.

Who is eligible for MNSure?

MNSure is a state-sponsored health insurance program available to Minnesota’s low-income residents. This is designed to help people get health care, but your eligible programs will vary depending on your status. If you are an immigrant, you may qualify for MinnesotaCare.

Who is eligible for Medicaid in Minnesota?

The eligibility for Medicaid in Minnesota is determined by a person’s income and the number of people in their household. To be eligible for Medicaid, a person must have an income under 138% of the federal poverty level.

How To Find the Cheapest Minnesota Health Insurance

Health insurance is essential financial protection for every individual and family. It’s not just about medical care but also about protection from financial losses in case of an accident or an illness. But how do you decide which is the right health plan for you?

You need to consider a few things when looking for a health insurance plan. For starters, the amount of coverage offered by the plan matters. You must consider how much you’ll pay for out-of-pocket expenses and co-pays for office visits or procedures. You also want to consider what your deductibles and out-of-pocket maximums are.

Once you decide on a type of plan that’s right for you, use our online quoting tool to find the cheapest rates.