UPDATED: SEPTEMBER 05, 2023 | 2 MIN READ

If you live in Connecticut, you can expect to pay an average of $575 for an individual health insurance plan. However, prices will vary based on health and other factors. To help you find the best health insurance plan for your needs, learn more about the Connecticut health insurance Marketplace, plan costs, and more.

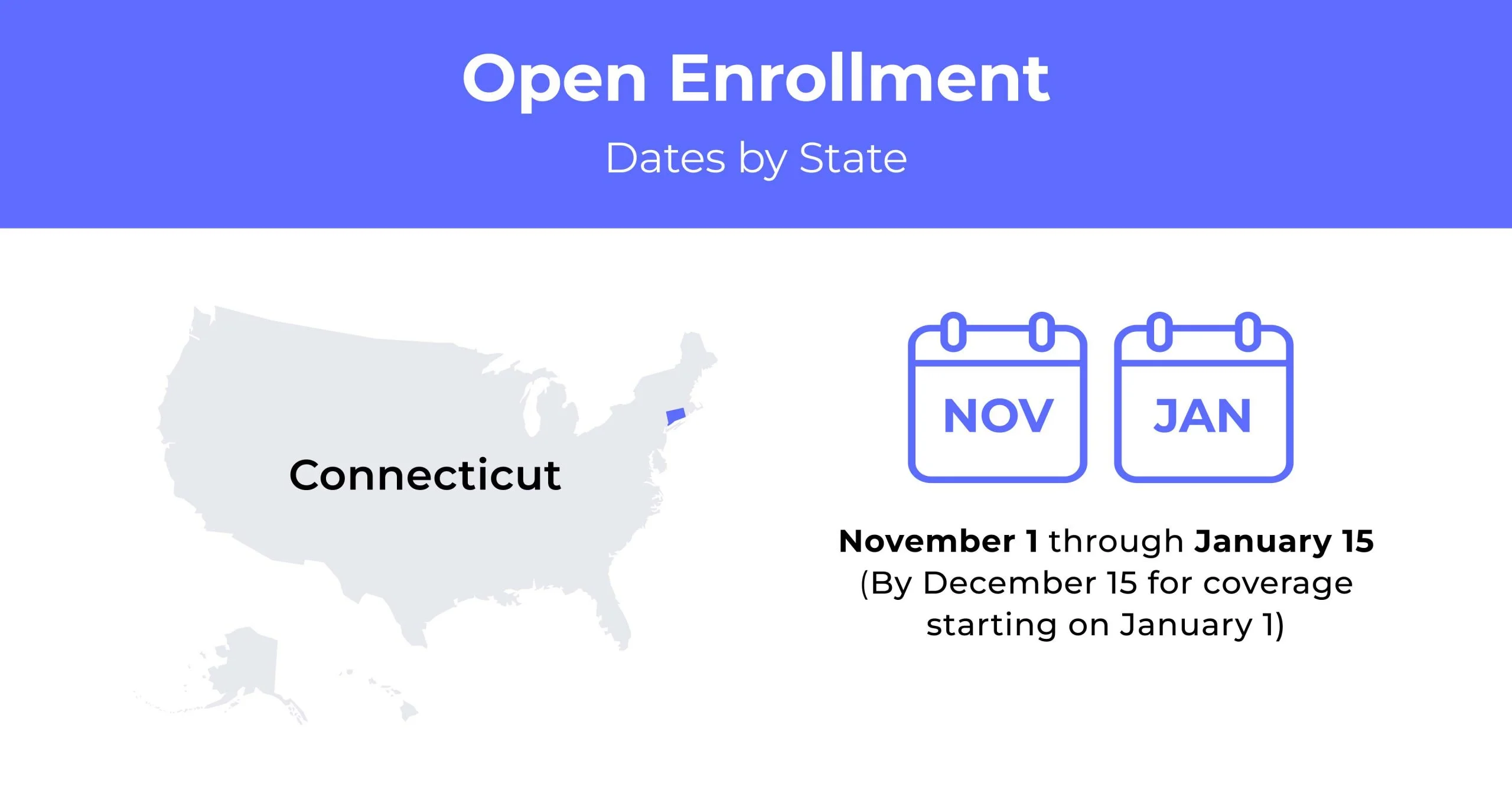

Connecticut Open Enrollment dates for health insurance

In Connecticut, Open Enrollment for health insurance runs from November 1st to January 15th each year.

Connecticut health insurance demographics

Like other states, health insurance prices in Connecticut vary based on age, zip code, gender, and other factors. Below are relevant statistics surrounding healthcare coverage in Connecticut:

- Average household income: The median household income in Connecticut is $79,855, around 23% more than the United States median household income of $64,994.

- Median age range: The median age range in Connecticut is 55-64 years old at 14.3%. The state’s largest age range is 35–54 at 25.7%.

- Education: About 91% of Connecticut residents are high school graduates, while 40% have college degrees. The state currently has about 6% of its residents enrolled in college.

What type of health insurance Marketplace does Connecticut have?

Connecticut’s health insurance Marketplace, Access Health CT, is state-run. In addition to shopping, comparing, and enrolling in individual and family healthcare plans, you can check to see if you qualify for financial assistance. You may enroll in free or low-cost coverage through Husky Health Program (Medicaid/CHIP) or the Covered Connecticut Program if eligible.

How many people are insured through the Connecticut health insurance Marketplace?

Although enrollment numbers dropped in 2020 and 2021, the numbers bounced back in 2022, with 112,636 people enrolling. This expected rebound was partly due to the American Rescue Plan’s subsidy enhancements, making 2022 coverage much more affordable.

Did Connecticut implement the ACA’s Medicaid expansion?

In 2010, Connecticut was the first state to implement Medicaid expansion. It also expanded the eligibility criteria for the program at the beginning of 2014. As of May 2021, almost 952,000 Connecticut residents have Medicaid coverage.

When can you purchase ACA health insurance in Connecticut?

Connecticut residents may purchase ACA health insurance during the Open Enrollment Period. In 2022, the open enrollment window in Connecticut ran from November 1, 2021, through January 15, 2022. To enroll outside the annual period window, you will need a qualifying event or a plan change.

Types of ACA plans in Connecticut

ACA health insurance plans in Connecticut are broken into four metal tiers: Bronze, Silver, Gold, and Platinum:

- Gold and Platinum health insurance plans typically have the highest premiums but are generally the best policies if you expect frequent medical expenses.

- Silver health plans are good policies for the average healthy consumer because of their lower premiums and deductibles.

- Bronze plans are the cheapest but have large deductibles and out-of-pocket maximums. They’re best for very healthy people that don’t need routine care.

What carriers offer ACA insurance in Connecticut?

ConnectiCare Insurance Company joined Access Health CT in 2022. There are two existing insurers that both have statewide coverage areas, totaling three insurers offering plans through Access Health CT:

- Anthem

- ConnectiCare Benefits, Inc.

- ConnectiCare Insurance Company

How much does health insurance cost in Connecticut?

Connecticut residents can expect to pay an average of $534 per person for a major medical individual health insurance plan. Keep in mind that prices will vary depending on multiple factors.

Cheapest health insurance by Metal Tier in Connecticut

Prices vary depending on your coverage level. Below are the cheapest individual plans by tier.

| Metal Tier | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|

| Bronze | $390 | $8,700 | $7,000 |

| Silver | $495 | $8,600 | $4,300 |

| Gold | $470 | $8,700 | $2,500 |

| Platinum | $620 | $3,000 | $1,200 |

Cheapest health insurance by county

Rates vary by location. The table below shows the cheapest family and individual health insurance options for the five biggest Connecticut counties.

| County Name | Individual, Age 40 | Couple, Age 40 |

|---|---|---|

| Fairfield | $580 | $1,160 |

| Hartford | $495 | $990 |

| Litchfield | $535 | $1,070 |

| New Haven | $535 | $1,070 |

| New London | $535 | $1,070 |

Can you purchase short-term insurance inConnecticut?

Although federal rules regarding short-term health plans were relaxed in 2018, Connecticut further enhanced its short-term health insurance rules in 2019. As a result, Connecticut doesn’t offer these temporary health plans.

Health coverage options for low-income people in Connecticut

Thanks to new laws and easier accessibility to coverage, low-income people in Connecticut now have several options: CHOICES (the state’s health insurance assistance program), Covered Connecticut, and more.

What Medicare options are available in Connecticut?

Connecticut’s Medicare Advantage program has four types of available plans: Health maintenance organization (HMO), preferred provider organization (PPO), private fee-for-service (PFFS), and special needs plan (SNP).

Medicaid In Connecticut

Connecticut’s Husky Health encompasses Medicaid and the Children’s Health Insurance Program. The Department of Social Services partners with Access Health CT in Husky Health enrollment as the administering agency. Husky provides a comprehensive healthcare benefits package, including preventive care, primary care, specialist visits, hospital care, behavioral health services, dental services, and prescription medications.

To be Medicaid-eligible in Connecticut, you must be a state resident needing health care/insurance assistance whose financial situation is low or very low.

You must also be one of the following:

- Have a disability or a family member in your household with a disability, or

- Blind, or

- Pregnant, or

- Responsible for a child 18 years of age or younger, or

- Be 65 years of age or older.

Annual pre-tax household income restrictions also apply.

Covered Connecticut

In 2021, Connecticut lawmakers funded Covered Connecticut, a new health coverage program. This program is available to households with at least one dependent child (under 19) and an income that’s 165-175% of the poverty level (155% plus a built-in 5% income disregard that applies to MAGI-based Medicaid eligibility determination).

Enrolling in Covered Connecticut, enrollees must be eligible for subsidies through Access Health CT, enrolled in a Silver-level plan, and claim 100% of the available subsidies.

Cheapest health insurance plans in Connecticut

If you’re shopping for cheap health insurance in Connecticut, you’ll find the best individual policies on Access Health CT. For the average consumer, the cheapest plan is currently the Choice Silver Standard POS plan from ConnectiCare. However, the cost of coverage depends on the county.

Cheapest health plan in Connecticut with low out-of-pocket maximums

If you expect frequent doctor visits and higher medical costs, purchasing a plan with higher monthly premiums and a lower out-of-pocket cost is best.

Connecticut’s cheapest plan with a low out-of-pocket maximum is Choice Gold Standard POS from ConnectiCare Benefits, Inc. The average 40-year-old man can expect to pay an average monthly premium of $654.

Cheapest health plan in Connecticut with high out-of-pocket maximums

Plans with high out-of-pocket maximums and lower premiums are generally best for younger people who want to keep their medical costs down. Remember that this also means higher out-of-pocket costs during unexpected medical emergencies.

Currently, the cheapest Connecticut plan with the highest out-of-pocket expense is a Passage Bronze Alternative PCP POS plan offered by ConnectiCare Benefits, Inc. This plan costs an average of $292 per month for a 26-year-old.

Cheapest health plan in Connecticut with an HSA option

Another option is getting a Health Savings Account (HSA) plan. They’re generally inexpensive and allow you to make pre-tax contributions. HSAs also earn you savings unless you use them for approved expenses.

Currently, the cheapest healthcare plan with a Health Savings Account (HSA) option is The Choice Bronze Standard POS HSA plan offered by ConnectiCare Benefits, Inc. It costs an annual average of $409 for a 40-year-old male.

Cheapest HMO/PPO/POS health plans in Connecticut

Gold and Platinum metal tiers are best if you are older and expect to pay frequent medical expenses. While these plans cost the most, they also have the lowest deductibles. Connecticut’s cheapest Gold/HMO plan is the Gold HMO BlueCare Prime, and the most cost-effective Platinum/POS plan is the FlexPOS Platinum Alternative.

FAQs

How much does health insurance cost in CT per month?

CT residents can expect an average of $534 per person for an individual health insurance plan.

Does Connecticut have free healthcare?

Connecticut Medicaid provides free or low-cost health coverage to those eligible.

Does Connecticut have good health insurance?

While Connecticut ranks sixth in the country for healthcare spending per capita between 2005-2019, the cost has risen by nearly three and a half times the median wage increase.

While Connecticut ranks well in healthcare surveys, there are major affordability and quality issues, particularly for people of color. The current system includes built-in disparities based on culture, race, ethnicity, income, and geography that lead to poorer healthcare quality.

How do you qualify for Access Health in CT?

To qualify for Husky Health (Medicaid/Children’s Health Insurance Program), you must be a Connecticut resident and a citizen (or U.S. national), a legal resident, or lawfully present for at least five (5) years.

To be eligible for Qualified Health Plans and the Covered Connecticut Program, you must be a non-incarcerated Connecticut resident, a citizen (or U.S. national), or a non-citizen who is lawfully present in the United States. Your eligibility for or enrollment in Medicare, Tricare, or VA benefits may impact your ability to enroll in a QHP.

What does CT Husky D cover?

Husky D covers adults ages 19-64 who do not have minor children whose income falls below 138% of the poverty level.

How to find affordable health insurance in Connecticut

If you’re looking for affordable health insurance in Connecticut, it’s important to understand the types of coverage available and your needs. When you’re ready for quotes, use our online health insurance tool to compare rates and find the cheapest coverage.