UPDATED: SEPTEMBER 05, 2023 | 1 MIN READ

There are many different Washington health insurance options if you’re looking for affordable alternatives. If you’re not eligible for Medicare or Medicaid, there are cheap options on the private insurance exchange. Finding the best health insurance in Washington state shouldn’t be difficult, and we’re here to make the process as easy as possible.

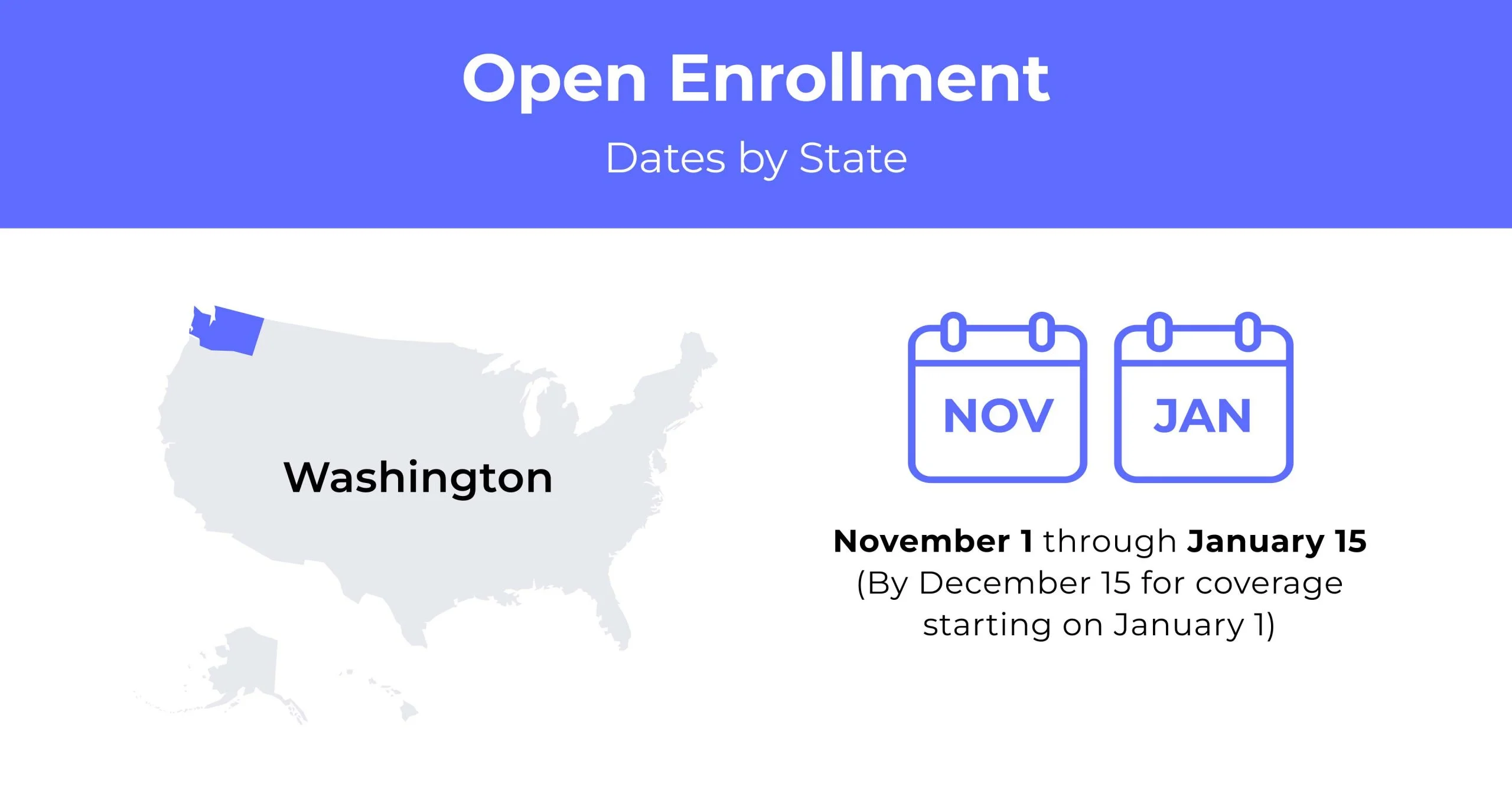

Washington Open Enrollment Dates For Health Insurance

Washington’s health insurance Open Enrollment period runs annually from November 1st to January 15th.

Washington Health Insurance Demographics

Washington’s health insurance demographics are important in determining eligibility for certain programs.

- Average Household Income: The average household income is $103,669. The Median household income is $77,006.

- Median Age Range: The median age is 37.8 years of age.

- Education: As of 2019, 91.7% of residents age 25 graduated from high school. In addition, there was an 84.2% increase in residents who obtained a bachelor’s degree or higher.

What Type Of Marketplace Does Washington Have?

Washington state has its own health insurance exchange called Washington Healthplanfinder. Twelve insurers within the Washington health insurance Marketplace provide 120 plans for 2022 through the exchange. The same plans move forward into 2023, except Community Health Network of Washington’s plan moves to their affiliate.

How many people are insured through Washington’s Marketplace?

There are 217,000 residents in Washington enrolled in health insurance through the exchange in 2018. There were 61% of those qualified for a subsidy within the exchange.

Did Washington implement the ACA’s Medicaid expansion?

Yes. Washington was one of the 27 states implementing the Medicaid expansion in 2014 under the Affordable Care Act. The enrollment in the expansion started in October 2013, but the coverage didn’t become available until January 1, 2014.

When can you purchase ACA insurance in Washington?

Washington health insurance enrollment in the exchange runs from November 1, 2022, to January 15, 2023. Outside the enrollment period, you need a qualifying event to change your existing coverage or enroll in the program. Native Americans can enroll in the program anytime, and residents eligible for Apple Health (Medicaid).

Types of ACA Plans In Washington State

Many types of Affordable Care Act plans in Washington offer different coverage plans. There are a few other carriers to choose from.

What carriers offer ACA insurance in Washington state?

For 2022, there are 12 insurers for your Washington health insurance. Providence is leaving the marketplace in Washington while Premera reduces its coverage area. Four insurers are increasing their coverage areas:

- UnitedHealthcare of Oregon

- BridgeSpan Health Company

- Community Health Network of Washington

- Premera Blue Cross

- Molina Healthcare of Washington

- Coordinated Care Corporation

- Kaiser Foundation Health Plan of Washington

- Kaiser Foundation Health Plan of Northwest

- Regence BlueShield

- LifeWise Health Plan of Washington

- PacificSource Health Plans

- Regence BlueCross BlueShield of Oregon

How Much Is Health Insurance In Washington State?

The average cost of health insurance in Washington is $443 monthly for a 40-year-old. Individual health insurance in Washington is available through the Washington Healthplanfinder Marketplace.

Cheapest Health Insurance By Metal Tier In Washington

There are three levels of insurance offered in Washington state. Residents can choose to have a lower deductible and out-of-pocket maximum by paying a higher premium. Below are the cheapest individual health insurance options for each metal tier.

| Metal Tier | Cheapest Plan | Monthly Premium | Deductible | Maximum Out-of-Pocket |

|---|---|---|---|---|

| Bronze | Ambetter Essential Care 1 | $265 | $8,600 | $8,600 |

| Silver | Ambetter Balanced Care 1 | $355 | $5,650 | $7,500 |

| Gold | Ambetter Secure Care 20 | $372 | $750 | $7,500 |

Cheapest Silver Health Insurance Plan By County

Health insurance costs often vary by location. As you can see in the table below, prices for both individual and family health insurance coverage vary between the largest counties in the state.

| County Name | Cheapest Plan | Cheapest Plan Cost | Average Cost in the County |

|---|---|---|---|

| Clark | Molina Cascade Silver | $440 | $495 |

| King | Virtual Plus Silver – 22 | $360 | $440 |

| Pierce | Community Health Network of Washington Cascade Select Silver | $375 | $445 |

| Snohomish | Community Health Network of Washington Cascade Select Silver | $385 | $430 |

| Spokane | Ambetter Balanced Care 1 | $360 | $410 |

Are Subsidies Available In Washington?

Washington provides state-funded subsidies for people starting in 2023. To qualify, you must have an income up to 250% of the poverty level. Enrollment occurs in Cascade Care plans at the silver or gold metal levels. The subsidy is called Cascade Care Savings.

Can You Purchase Off-Exchange Coverage In Washington?

No, Washington only provides insurance within the exchange. Washington state has its own health insurance exchange called Washington Healthplanfinder.

Can You Purchase Short-Term Insurance In Washington?

There was a change in short-term insurance plans in 2019. Washington limited the plans to no more than three months, and renewals are prohibited. In addition, short-term plans aren’t allowed to be sold in Washington during open enrollment in the exchange between November to January. LifeMap is the only insurer that offers short-term plans.

Insurance Coverage For Low-Income People In Washington

There are a few different types of insurance plans available for health insurance in Washington for low-income people. Medicare and Medicaid are great options to choose from.

What Medicare Options Are Available In Washington?

Medicare is available to residents over the age of 65 and those under 65 with a disability or illness. You may have to pay part of the premium, but it is still cheaper than private insurance.

Medicare Advantage is an additional option for Washington residents. These are often seen as an all-in-one plan because they have prescription drug coverage.

If you have a Medicare plan without prescription coverage, you can get Medicare Part D. This covers some of the costs for name-brand and generic prescription drugs.

Medicaid In Washington

Medicaid is free health insurance in Washington for those qualified. Medicaid is part of the expansion in Washington. You and your family qualify if your income is less than 138% of the federal poverty line.

Cheapest Health Insurance Plans In Washington

There are a few different options available for cheap health insurance in Washington. Whether you’re looking for low out-of-pocket costs or a low premium, options are available.

Cheapest health plan in Washington with low out-of-pocket maximums

If you have high medical expenses, then a plan with a low-out-pocket maximum is the best bet. The premium is high, but you’re likely to reach your out-of-pocket limit quickly, and your insurance company takes over paying your medical bills. The cheapest out-of-pocket rate is $5,250 with Molina Cascade Gold and a monthly premium of $439.

Cheapest health coverage in Washington state with high out-of-pocket maximums

People with low medical expenses find plans with high out-of-pocket costs to be the best. The only time you pay the high prices is during a medical emergency. Otherwise, your premiums are low. The out-of-pocket maximum is roughly $8,250 with Ambetter Essential Care 1. Their monthly premium is $221.

Cheapest health plan in Washington with an HSA option

Health Savings Accounts (HSA) are great for people with low medical costs. It’s a tax-free savings account used to pay your insurance deductibles. The cheapest HAS is LifeWise Essential Bronze HSA, with a monthly cost of $319.

Cheapest HMO/PPO/POS health insurance plans in Washington

Washington health insurance plans available are Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO), and Exclusive Provider Organization (EPO) plans. HMOs are the cheapest but have a limited network of providers. PPOs are more expensive, but you have the option of seeing out-of-network doctors. EPOs are also more expensive, but you don’t require a referral to see specialists. The cheapest insurers are:

- HMO: Ambetter Silver Plan for $377 monthly

- PPO: Navigator Silver 5000 for $484 monthly

- EPO: Community Health Network of Washington for $412 monthly

FAQs

How much is health insurance in Washington state per month?

The average cost of health insurance in Washington is $443 monthly for a Silver plan.

Does Washington state have free healthcare?

Free healthcare is available with Medicaid if you fall below 138% of the federal poverty line.

Is it required to have health insurance in Washington?

Under the Affordable Care Act, residents must enroll in Washington health insurance or pay the penalty.

What is the most popular health insurance in Washington state?

Washington’s most popular health insurance is Kaiser, Molina, or LifeWise.

Is healthcare good in Washington state?

Washington is listed as number 8 in the top ten list of the best healthcare in the United States.

How To Find the Best Health Insurance In Washington State

Finding the best health insurance in Washington state isn’t hard. It’s important to review the coverage and rates of several plans, including the premium, deductible, and out-of-pocket expenses. Use our online health insurance quote tool to find a plan today.