Insurance Advice

Does My Personal Auto Insurance Cover Business Use?

In this modern era of ride-sharing, delivery driving, and more, more employees and business owners are on the road for work in their vehicles. Understanding how your auto insurance works and if you’ll be covered in the event of an accident if using your car for business is paramount. Let’s determine if and when your […]

UPDATED: JULY 06, 2023

Should You Have Rental Car Reimbursement Coverage?

It can be quite stressful when you’re involved in an auto accident and must send your vehicle to the repair shop. You are reeling from the aftermath of an accident and may find yourself without a car. Thankfully, rental car reimbursement coverage can help. Rental car reimbursement is an add-on coverage designed to step in […]

UPDATED: APRIL 27, 2023

Best Car Insurance For Young Drivers

Looking for the best car insurance for young drivers? Young motorists are far more likely to end up in a car accident than any other age group. On top of that, young drivers’ accidents are often more severe when compared to other drivers. And because of this, insurance premiums for drivers in the age range […]

UPDATED: JULY 08, 2025

Best Car Insurance For DoorDash Drivers

Food delivery drivers for DoorDash and other delivery services may love the freedom of working when they want, but there are a few things to know to find the best car insurance for DoorDash drivers. Working for DoorDash requires car insurance, but your personal car insurance coverage typically won’t apply when you pick up or […]

UPDATED: JULY 08, 2025

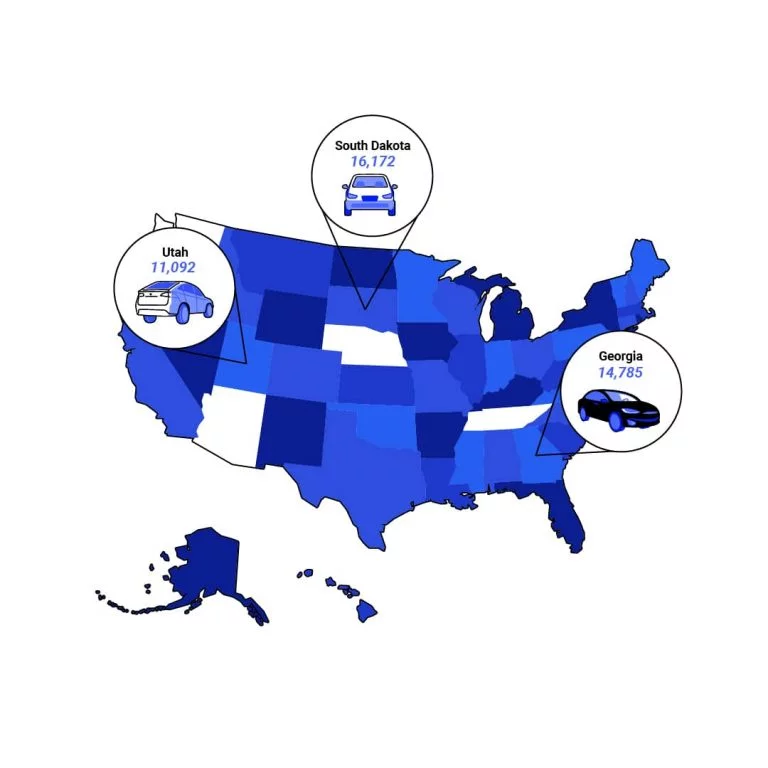

What’s the Average Annual Miles Driven In Each State?

Americans throughout the nation rely heavily on the ability to drive to and from their desired destinations. Whether you drive for a living or you drive to take care of personal errands such as school or grocery shopping, it’s easy to put miles on your vehicle. Let’s review how many miles the average motorist puts […]

UPDATED: JUNE 23, 2023

Most Significant Financial Risks To Your Home

Your home is always one of the most important (and expensive) assets to protect. Even with good home insurance, this can involve out-of-pocket costs and high premiums for certain areas of protection. This makes affordability difficult for the average American family, especially first-time buyers. The best way to plan for unexpected expenses in keeping your […]

UPDATED: JULY 08, 2025

Car Insurers Are Refusing To Cover Some Kias and Hyundais

Some Hyundai and Kia owners may soon shop for a new insurance carrier. After an uptick in car thefts of specific models of these brands’ cars after a social media trend, major insurance companies are temporarily halting coverage for some owners and raising rates for existing policyholders. Let’s look at why this is happening, what […]

UPDATED: AUGUST 07, 2023

Why You Should Be Shopping For Car Insurance Every 6 Months

Most car insurance policies have a six-month lifespan, and the half-year mark is a great time for shopping for car insurance. Here are some reasons to shop for car insurance twice a year. 7 Reasons to shop for car insurance every 6 months Adding a new vehicle to your policy isn’t the only reason you […]

UPDATED: APRIL 27, 2023

Road Rage Statistics in 2022

Car ownership is expensive, especially with auto insurance premiums and unforeseen accidents. Every year, a portion of accidents can be attributed to road rage. This is especially risky for commuters and people who regularly use high-speed expressways or travel through busy areas with higher traffic volumes. While you can account for your road rage and […]

UPDATED: AUGUST 07, 2023

Natural Disaster Statistics In 2022

Natural disasters and extreme weather are the most common reason for home insurance claims, no matter where you live. Historically, wind and hail account for nearly half of home insurance claims yearly. As climate change becomes an increasingly immediate concern, this is likely to worsen in the coming years. Different natural hazards will plague different […]

UPDATED: APRIL 27, 2023