UPDATED: AUGUST 09, 2023 | 2 MIN READ

When it comes to taxes, there are a lot of ‘gray areas.’ One common question is whether or not health insurance premiums are tax deductible. The answer isn’t always clear-cut, but we’ll clarify the matter.

According to the IRS, “Your health insurance premiums are tax deductible as an adjustment to income if you’re self-employed.” However, you must meet certain restrictions and requirements for this deduction to apply.

Health insurance premiums are generally tax-deductible

Is health insurance tax deductible? In most circumstances, yes! The Internal Revenue Service allows health insurance premiums as a deduction from taxes as long as the policyholder meets specific criteria.

To qualify for deductions, those paying out of pocket can deduct medical expenses over 7.5% of their Adjusted Gross Income if their total medical expenses surpass that benchmark. It is important to note that other restrictions may apply based on individual circumstances.

Suppose you were laid off during 2020 due to the COVID-19 pandemic and are paying your insurance premiums through COBRA.

Your employer’s contribution may be fully or partially tax deductible. Please check with your employer and accountant on how this applies to you.

Health insurance premiums that are tax-deductible

When filing your taxes, you may be eligible to deduct any out-of-pocket health insurance premiums for medical care policies.

Such policies may cover treatments like hospitalization, surgery, X-rays, prescription drugs, insulin, dental care, lost or damaged contact lenses, and long-term care services.

These deductions apply to your spouse and any dependents. Additionally, premiums for COBRA insurance and Medicare Parts B and D are deductible.

Suppose you are not on Medicare through Social Security or are a former government employee who paid Medicare taxes.

In that case, premiums received from Medicare Part A may also be considered a tax-deductible expense.

Suppose you buy health insurance through the federal or state marketplaces. In that case, out-of-pocket premiums paid are also eligible for deductions.

Self-employed individuals can benefit from deducting health insurance and qualified long-term care insurance premiums when filing taxes.

This lowers their adjusted gross income and tax bill. Additionally, medical and dental expenses may be itemized as deductions on Schedule A of the IRS Form 1040.

Generally speaking, not all medical expenses are eligible for a deduction, only those which surpass 7.5% of the adjusted gross income.

Health insurance premiums that aren’t tax-deductible

It is important to note that not all health insurance premiums are eligible for tax deductions. For example, any part of your employer’s premium, taken out of your paycheck as a pretax contribution, isn’t a deduction for your taxes.

Additionally, for those enrolled in Medicare through Social Security, the Medicare A premiums are not tax-deductible as Social Security pays for them.

Suppose you receive a subsidy to help cover your premiums through a state or federal insurance Marketplace. In that case, only the amount you pay out of pocket is eligible for deduction.

What medical expenses are tax-deductible?

Health insurance premiums are some of the many medical expenses that are tax deductions.

Health insurance premiums and other healthcare-related expenses, such as doctor visits, prescription costs, and other medical bills, can also reduce an individual’s taxable income.

If you are self-employed, you may also be eligible to deduct health insurance premiums paid during the year. However, eligibility depends on filing status and meeting specific IRS criteria.

To maximize deductions in this area, it’s essential to understand what types of health expenses qualify for a write-off and which do not.

All applicable deductions can help many taxpayers save when filing their taxes.

In addition to health insurance premiums, other eligible medical expenses may include the following:

- Acupuncture treatments

- Admission and transportation to a medical seminar related to your, your spouse’s, or your dependent’s chronic illness

- Dental insurance premiums

- Dental treatments and preventative dental care

- Dentures, eyeglasses, contact lenses, hearing aids, crutches, and wheelchairs

- Equipment needed for medical disabilities

- Long-term care insurance premiums

- Mental health services

- Nursing home care – however, you can only deduct the costs for medical care, not meals and lodging.

- Inpatient hospital care – including inpatient treatment for alcohol or drug addiction

- Medical practitioners – dentists, doctors, chiropractors, psychiatrists, and psychologists

- Participation in a smoking cessation program and prescription drugs to ease nicotine withdrawal.

- Preventive medical care

- Prescription drugs

- Service animals to assist people with physical disabilities

- Transportation to medical care qualifies as a medical expense

- Travel and lodging expenses for medical appointments

- Treatments for certain disease

- Vision insurance premiums

- Weight-loss programs for diseases, including obesity

- Wheelchairs

You must be aware that you may only be eligible to deduct the cost of qualifying medical expenses once the amount you pay passes 7.5% of your AGI.

Expenses covered by a health plan or employer are not deductible.

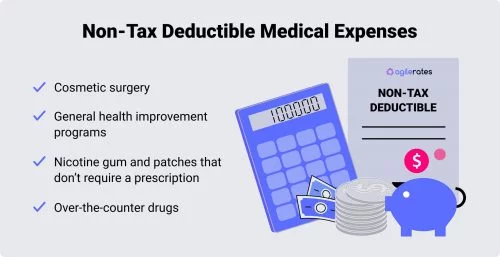

Medical expenses that aren’t tax-deductible

To be eligible for the deduction, expenditures must be for medically required treatments and/or equipment. This excludes costs such as:

- Cosmetic surgery

- General health improvement programs

- Nicotine gum and patches that don’t require a prescription

- Over-the-counter drugs

Standard vs. itemized deductions

Taking the itemized deduction may be worthwhile if you incurred numerous unreimbursed medical or dental expenses in the tax year.

However, it is essential to remember that those costs must exceed 7.5% of your AGI plus the standard deduction for your filing status for the deduction to be of benefit.

Selecting the option that results in the lowest Adjusted Gross Income (AGI) is advisable, and nearly 90% of taxpayers opt for the standard deduction.

Those who are not self-employed can only receive a tax benefit from their health insurance costs if they itemize deductions on their income tax return.

If your Adjusted Gross Income for the taxable year is $90,000 and you have incurred $150,000 in medical expenses due to treatments, surgeries, medications, and hospital stays.

It makes the most sense to opt for the itemized deduction as it surpasses the 7.5% AGI threshold and the standard deduction.

On the other hand, the standard deduction would be the more suitable option if you only have $5,000 worth of unreimbursed medical costs.

It’s important to note that only qualifying medical expenses are deductible. Taking the standard deduction is still more beneficial if your medical expenses are large but do not meet the requirements.

Most taxpayers are advised to utilize the standard deduction; however, itemizing deductions may be a wiser choice if you incur significant medical expenses throughout the year. To help determine which deduction is most beneficial for you, compare the amount of itemized deductions to the standard deduction and select the option that yields the highest refund.

Self-employed health insurance deduction

Suppose you are self-employed and have a net income for the tax year. In that case, you may be eligible to deduct medical insurance premiums for yourself, your partner, and your dependents.

This deduction is for medical insurance that decreases your adjusted gross income, not as part of an itemization of expenses.

FAQs

Can you write off health insurance premiums?

You may be able to deduct the premiums for health insurance as a medical expense since these premiums are paid out-of-pocket with pretax dollars.

You can use the deduction if you opt for the itemized deduction and your total annual medical expenses exceed 7.5% of your AGI.

Are my premiums tax-deductible if I qualify for federal premium subsidies?

If you are eligible for an Advance Premium Tax Credit (APTC), an income-based premium subsidy. Any premium payments repaid to you through an APTC aren’t tax deductible.

However, any remaining premiums can be denied.

Is my supplemental health insurance premiums tax deductible?

Tax deductions may be available for supplemental health insurance premiums such as hospital indemnity insurance and critical illness insurance.

The total of such expenses plus the medical expenses exceed 7.5% of your Adjusted Gross Income (AGI), and you choose to itemize deductions.

Is my COBRA health insurance premiums tax deductible?

COBRA health insurance premiums are eligible for deduction on your federal income taxes if you itemize your deductions and your medical expenses exceed 7.5% of your Adjusted Gross Income for the appropriate tax year.

Is my Health Savings Account premiums tax deductible?

Given your filing status and circumstances, those with a high-deductible health plan can deduct contributions to a Health Savings Account (HSA) from their taxable income.

For the 2023 tax year, the maximum contribution for individuals is $3,850; for family coverage, the limit is $7,750.

You may be able to deduct the premiums for health insurance as a medical expense since these premiums are paid out-of-pocket with pretax dollars. You can use the deduction if you opt for the itemized deduction and your total annual medical expenses exceed 7.5% of your AGI.

Get help finding affordable health insurance

Health insurance can be even more expensive if you don’t have someone helping you navigate the process. Researching and finding a plan that meets all your needs for affordable health insurance is vital.

Additionally, there are ways to take advantage of tax deductions for health care premiums. Investigating which deductions may apply to your particular situation is vital.

Understanding how health insurance premiums can be tax deductible can help offset some costs associated with healthcare coverage. It also makes it easier to get the coverage you need at a price that works for you.

In general, health insurance premiums are tax deductible. However, some exceptions exist, such as if you are self-employed or have a health savings account.

Reviewing health insurance rates in your area is quick and easy. Just fill out our online request form, and we’ll connect you with a licensed insurance agent specializing in health insurance.

Related content

- What is Form 1095 and Why It’s Important?

- Self-Employment Health Insurance Deduction

- Are There Tax Penalties For No Health Insurance?

- Complete Guide on All Types Of Health Insurance Plans

- What happens if you can’t afford healthcare in America?