UPDATED: AUGUST 10, 2023 | 1 MIN READ

Health insurance is both loved and hated by millions of Americans. It’s important to have as healthcare can be expensive, and many can’t afford healthcare in America without it.

Even with health insurance, the U.S. healthcare cost is extremely high. The out-of-pocket costs can quickly get out of hand.

The consequences of going without coverage for necessary healthcare needs can be severe, causing an impact on physical health, financial stability, and quality of life.

Let’s explore the challenges individuals and families have when they struggle to access medical care due to financial barriers and the options available for obtaining the care they need.

Importance of healthcare access

It’s essential to have access to healthcare to maintain health and well-being. Having sufficient health insurance allows people to prevent, manage, and treat medical conditions, which can be life-saving in emergencies.

Although more than 90% of Americans have health insurance, it doesn’t guarantee affordable healthcare. Health insurance can significantly reduce medical costs, but millions of Americans still face the challenge of unaffordable healthcare.

In fact, according to the U.S. Census, an estimated 27 million U.S. citizens, or 8% of the population, were uninsured in 2021.

Additionally, healthcare access promotes social and economic stability, as healthy individuals are more productive and can participate in society.

- Prevents and manages medical conditions

- Provides life-saving emergency care

- Promotes social and economic stability

- Improves overall quality of life

- Reduces healthcare disparities

- Encourages preventative care and early intervention

- Increases life expectancy

- Supports individual and community health

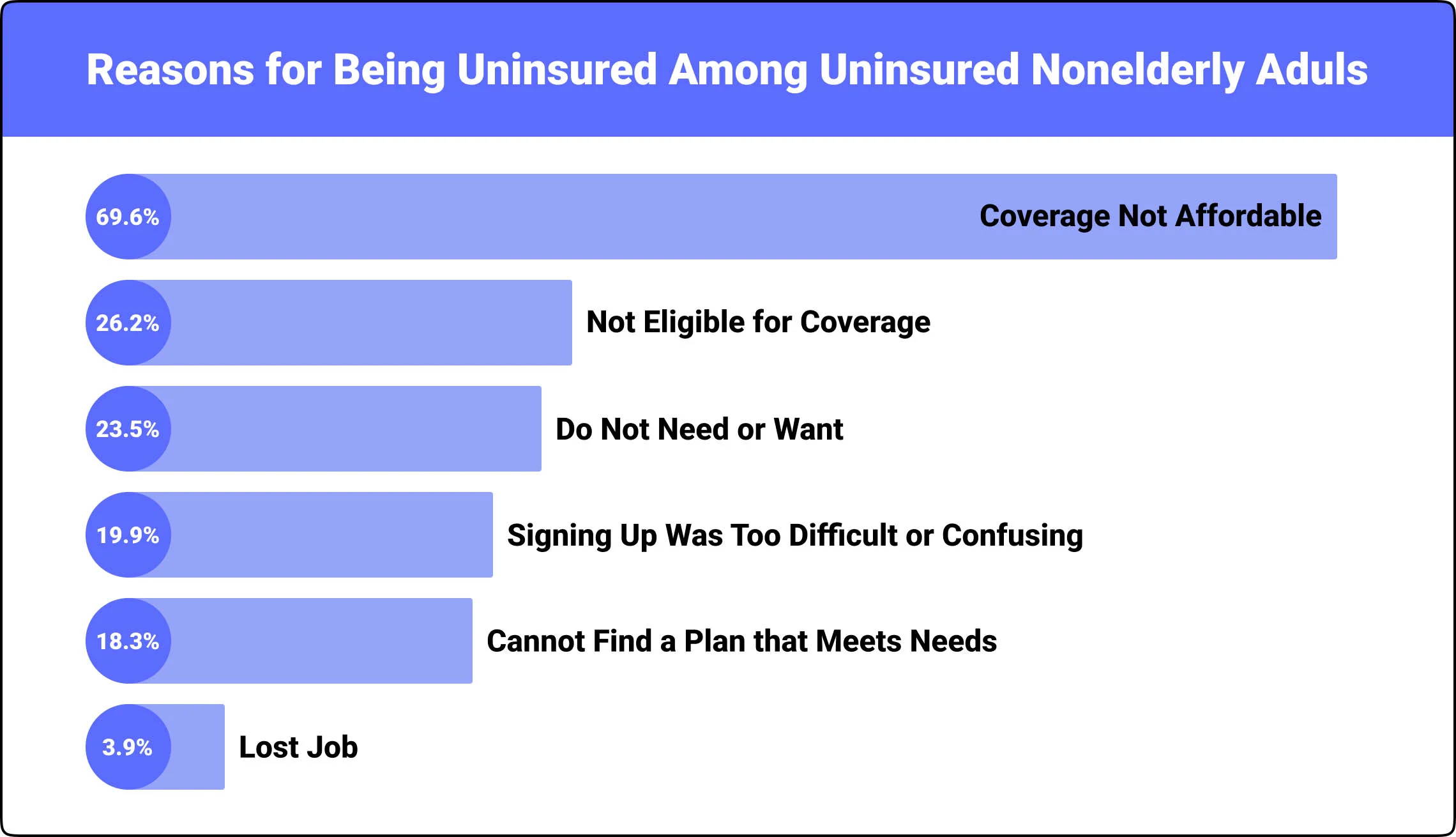

Why would Americans go uninsured?

There are several reasons why someone would opt out of health insurance. According to a survey by the Kaiser Family Association, the most common and most significant reason was affordability.

The other reasons listed were ineligible for coverage, didn’t want or didn’t need insurance, the confusing process to sign up, available plans that didn’t fit the individual’s needs, and loss of employment.

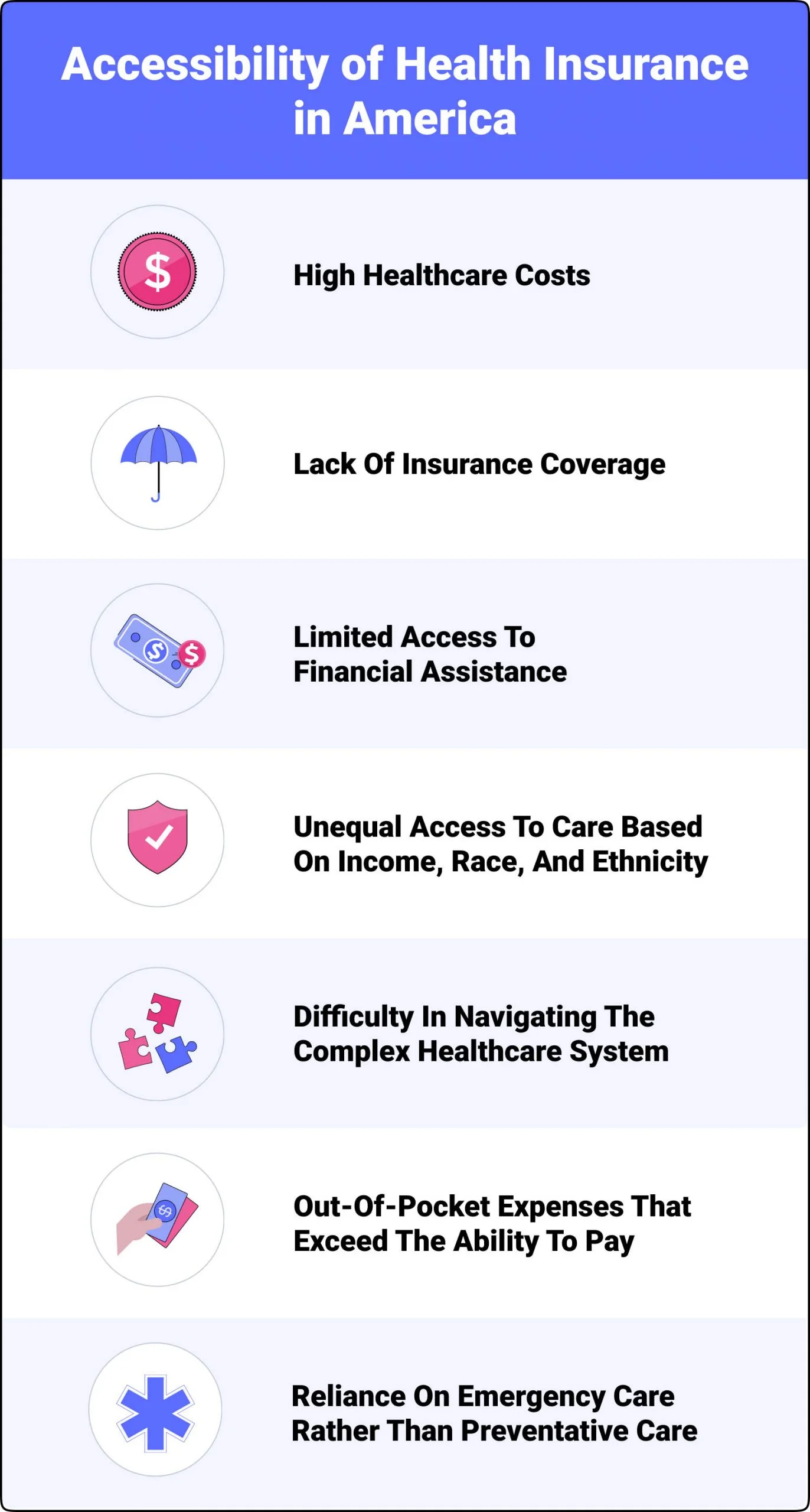

Accessibility of health insurance in America

Affordability is the number one issue with the American healthcare system, with many individuals and families struggling to pay for necessary medical care or health insurance coverage.

This can create significant barriers to healthcare access for many Americans. The most pressing issues related to healthcare access include:

- High healthcare costs

- Lack of insurance coverage

- Limited access to financial assistance

- Unequal access to care based on income, race, and ethnicity

- Difficulty in navigating the complex healthcare system

- Out-of-pocket expenses that exceed the ability to pay

- Reliance on emergency care rather than preventative care

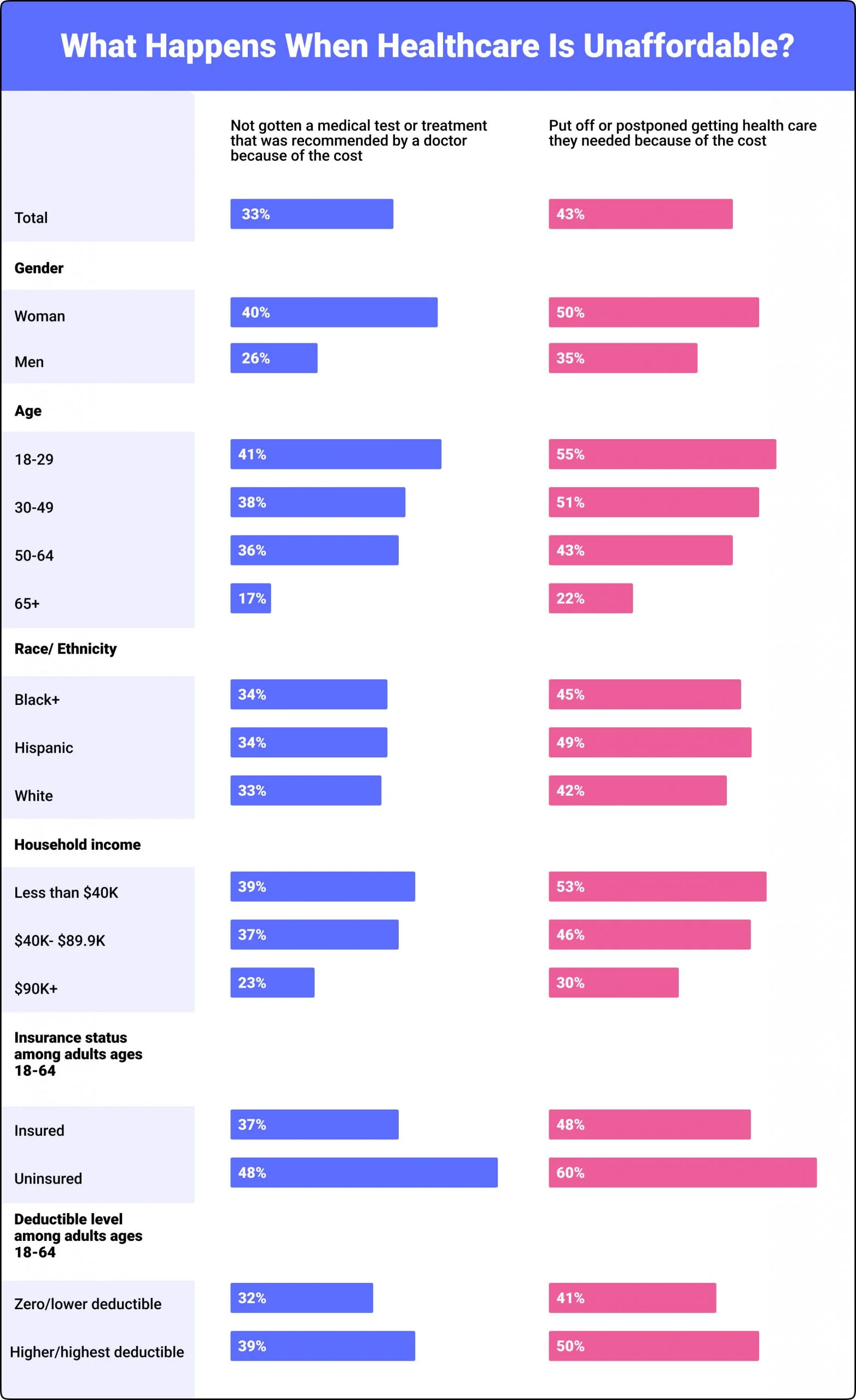

What happens when healthcare is unaffordable?

In situations where healthcare is not affordable, various issues occur. Not just emotional feelings of stress and worry but physical and tangible problems. When an individual or family has to choose between paying for necessities and health insurance, it results in treatments being missed, potential financial ruin, and may lead to death.

Skipping and delaying medical care

The high cost of medical care can seriously affect an individual’s health in the short and long term. One major effect of the financial barrier to medical care is delayed or skipped medical treatment, which can lead to worsening health conditions over time.

For instance, untreated illnesses and conditions can progress, and preventative measures such as routine check-ups and screenings may not be accessible to those who can’t afford medical care. This can result in late detection of health issues and worsen outcomes.

Chronic illnesses like diabetes and heart disease require regular medical attention to manage effectively. Without proper care, these conditions can result in serious health consequences such as heart attacks, strokes, and organ damage.

Therefore, the inability to afford medical care can negatively affect the health conditions of individuals and families, leading to long-term health problems and complications without medical treatment.

Financial burden and bankruptcy

According to a 2021 study published in the Journal of the American Medical Association (JAMA), medical debt is a significant issue in the United States.

Shockingly, the study revealed that 17.8% of individuals have medical debt sent to collections, highlighting the extent of the problem.

This suggests that many individuals in the United States struggle to afford medical expenses, which can have severe consequences for their financial well-being and access to healthcare.

In addition, the American Bankruptcy Institute, medical debts are the number one reason for bankruptcy in America.

Increased mortality rates

Unsurprisingly, if people can’t access necessary medical care, the chance of death increases. Lack of affordable healthcare inevitably increases the mortality rates in America.

Impacts of high healthcare costs

When healthcare costs are higher than many can afford, it leads to an unhealthy and impoverished community. This can lead to spreading diseases and infections due to not being able to afford necessary treatment.

Lack of insurance coverage

While insurance coverage is available for Americans with the lowest incomes, many fall into a gap of too much income to receive assistance and insufficient income to meet their needs.

These individuals and families are among those that need insurance coverage the most, but there isn’t any assistance for them. They often forgo health insurance since they must choose between items to survive daily.

Low income and poverty

Many low-income Americans can rely on the Medicaid program for their healthcare needs. Medicaid help pays for medically necessary medical costs for individuals with low income. This is positive for individuals and families in this situation, but they are very limited on what doctors they can use.

Options for accessing medical care

There are several options for accessing medical care in the United States, including private insurance, public insurance programs such as Medicare and Medicaid, and out-of-pocket payments.

- Private insurance plans can be obtained through employers, on the individual market, or through organizations such as labor unions or professional associations.

- Public insurance programs are available for certain populations, such as elderly and disabled individuals, through Medicare and low-income individuals through Medicaid.

For those who do not have insurance coverage, out-of-pocket payments can be made, though this option can be prohibitively expensive for many individuals and families.

Despite the various options for accessing medical care, affordability remains a significant challenge for many Americans.

Medicaid and other public programs

Medicaid is a public insurance program that provides healthcare coverage for low-income individuals and families in the United States.

Other public programs include Medicare for elderly and disabled individuals and programs that provide coverage for military veterans and their families.

Medicaid coverage varies by state; some states provide more generous coverage than others.

Despite the availability of public programs, many individuals may still struggle to access affordable medical care, particularly if they fall into the coverage gap where they do not qualify for Medicaid but also can’t afford private insurance.

Charity care and financial assistance programs

Charity care and financial assistance programs are options for individuals who can’t afford medical care and do not qualify for public insurance programs.

Many hospitals and healthcare providers offer charity care to uninsured or underinsured patients, and some also have financial assistance programs that provide discounted or free care to low-income patients.

However, the availability of charity care and financial assistance programs varies by location and can be limited in some areas, leaving many individuals needing access to affordable medical care.

Negotiating medical bills and payment plans

For those who are unable to afford medical bills, negotiating with healthcare providers can be a way to reduce costs and access necessary medical care.

- Many healthcare providers are willing to work with patients to develop payment plans and negotiate bills, especially for the uninsured or underinsured.

- Patients can also explore options for financial assistance or charity care through the healthcare provider or other organizations.

However, negotiating medical bills may only sometimes be possible, and some individuals may still need help accessing affordable medical care despite these efforts.

Community health centers

These health centers are an important resource for individuals who lack access to affordable medical care, or that can’t afford healthcare.

They provide comprehensive primary care services, including medical, dental, and mental health services, to individuals and families regardless of their ability to pay.

Community health centers receive federal funding to care for uninsured or underinsured patients, making them a valuable resource for low-income individuals and families.

In addition to offering affordable medical care, community health centers also provide outreach and education programs to promote health and wellness in the community.

Navigating the complex healthcare system

It can be overwhelming to figure out how to navigate the healthcare system, especially for Americans that can’t afford healthcare

Understanding medical bills and insurance coverage can be difficult, leading to unexpected costs and financial strain.

However, resources such as patient advocates, insurance agents, and navigators are available to help individuals understand the healthcare system.

These professionals can guide how to access medical care, understand medical bills, and navigate insurance coverage, making healthcare more accessible and affordable for those who need it most.

Understanding Health Insurance

Understanding health insurance is crucial to accessing affordable healthcare in America. Health insurance can be complex, with various plans and coverage options, deductibles, copays, coinsurance, and out-of-pocket maximums.

Individuals should take the time to research and understand their health insurance options, including the costs and coverage limitations, to make informed decisions about their healthcare.

Additionally, individuals should be aware of their rights as a consumer and know how to navigate the appeals process if they are denied coverage or face unexpected medical bills.

Researching and Comparing Healthcare Costs and Providers

Researching and comparing healthcare costs and providers is important to finding affordable healthcare in America.

With the rise of healthcare costs, it’s essential to be a savvy consumer and shop around for the best prices and quality of care.

Patients can use online tools to compare prices and quality metrics for medical procedures, medications, and services offered by different providers.

Additionally, patients can ask their healthcare providers about cost estimates upfront and inquire about any available discounts or payment plans to help make healthcare more affordable.

Seeking assistance from healthcare advocates

If you’re struggling to navigate the healthcare system or to afford medical care, it can be helpful to seek the assistance of healthcare advocates or a licensed insurance agent.

Healthcare advocates can help you understand your options for care, assist you in negotiating medical bills, and find resources for financial assistance.

Insurance agents can also help you navigate complex insurance policies and find providers that meet your needs and budget.

Staying Proactive and informed

Staying proactive and informed about navigating health insurance is essential to accessing affordable healthcare.

This includes regularly reviewing and updating insurance plans, understanding coverage options, and utilizing available resources to compare costs and providers.

By staying informed and engaged, individuals can make informed decisions about their healthcare and ensure they receive the best possible care at the most affordable price.

FAQ

Can poor people get free healthcare in America?

Yes! Programs such as Medicaid and CHIP (Children’s Health Insurance Program) provide coverage for low-income individuals and families. These programs also include coverage for pregnant women, children, older Americans, and individuals with disabilities.

Is it cheaper not to have health insurance in the U.S.?

Lack of health insurance can result in significantly higher medical expenses.

Healthcare providers may charge uninsured patients much more for the same services their insurance plan would otherwise cover.

Without health insurance, individuals may have to bear the full brunt of these expenses, leading to substantial financial strain.

How much do you have to pay for healthcare in America?

The United States is known to have one of the highest healthcare costs globally, with staggering spending of $4.3 trillion in 2021, equating to an average of $12,900 per person. Such a high healthcare cost can significantly burden individuals, families, and the economy.

How many U.S. citizens can’t afford health care?

According to the American Community Survey, the number of Americans with health insurance in 2021 reached an all-time high of nearly 299 million. Americans without health insurance decreased by 1.4 million from 2019 to just over 28 million.

Why are so many Americans uninsured?

Although policymakers have tried to make healthcare coverage more affordable, many people who lack coverage still struggle with high costs. In 2021, most uninsured adults (64%) reported not having coverage because the cost was too expensive.

The high cost of healthcare in America can be financially devastating for those who cannot afford it. Lack of insurance coverage, low income, and poverty can all make healthcare unaffordable.

However, there are options for accessing medical care, such as Medicaid, charity care programs, negotiating medical bills, and community health centers.

It’s essential to understand health insurance, research and compare healthcare costs and providers and seek assistance from healthcare advocates to navigate the complex healthcare system.

If you’re struggling to afford healthcare, reviewing plans in your area is important to find the best option for your and your family’s health and financial well-being.

Sources

- “Key Facts About the Unisured Population” – (Kaiser Family Foundation)

- “Many Patients Can’t Afford Health Costs Even With Insurance” – (Pew Trusts)

- “Who Can’t Pay for Health Care” – (NIH National Library of Medicine)

Related content