UPDATED: SEPTEMBER 06, 2023 | 1 MIN READ

ACA Bronze Plans are crucial in providing a viable option for individuals and families across the United States. These plans balance cost and coverage, making them an attractive choice for many. This article will delve into the workings of ACA Bronze Plans, shedding light on their coverage, benefits, and cost-sharing aspects.

Additionally, we’ll provide essential links to state-specific ACA Marketplaces and resources, allowing you to explore the options available in your area. Discover how ACA Bronze Plans can help you secure the necessary healthcare coverage while keeping costs in check.

Understanding ACA Bronze Plans

To make informed decisions about your healthcare coverage, it’s crucial to have a clear understanding of ACA Bronze Plans. Next, we’ll explore what these plans entail, their coverage and benefits, and the important aspect of cost sharing.

By gaining insights into these key factors, you can assess whether ACA Bronze Plans align with your healthcare needs and financial considerations. Let’s dive in and unravel the details of ACA Bronze Plans to make an informed choice about your health insurance.

What is an ACA Bronze plan?

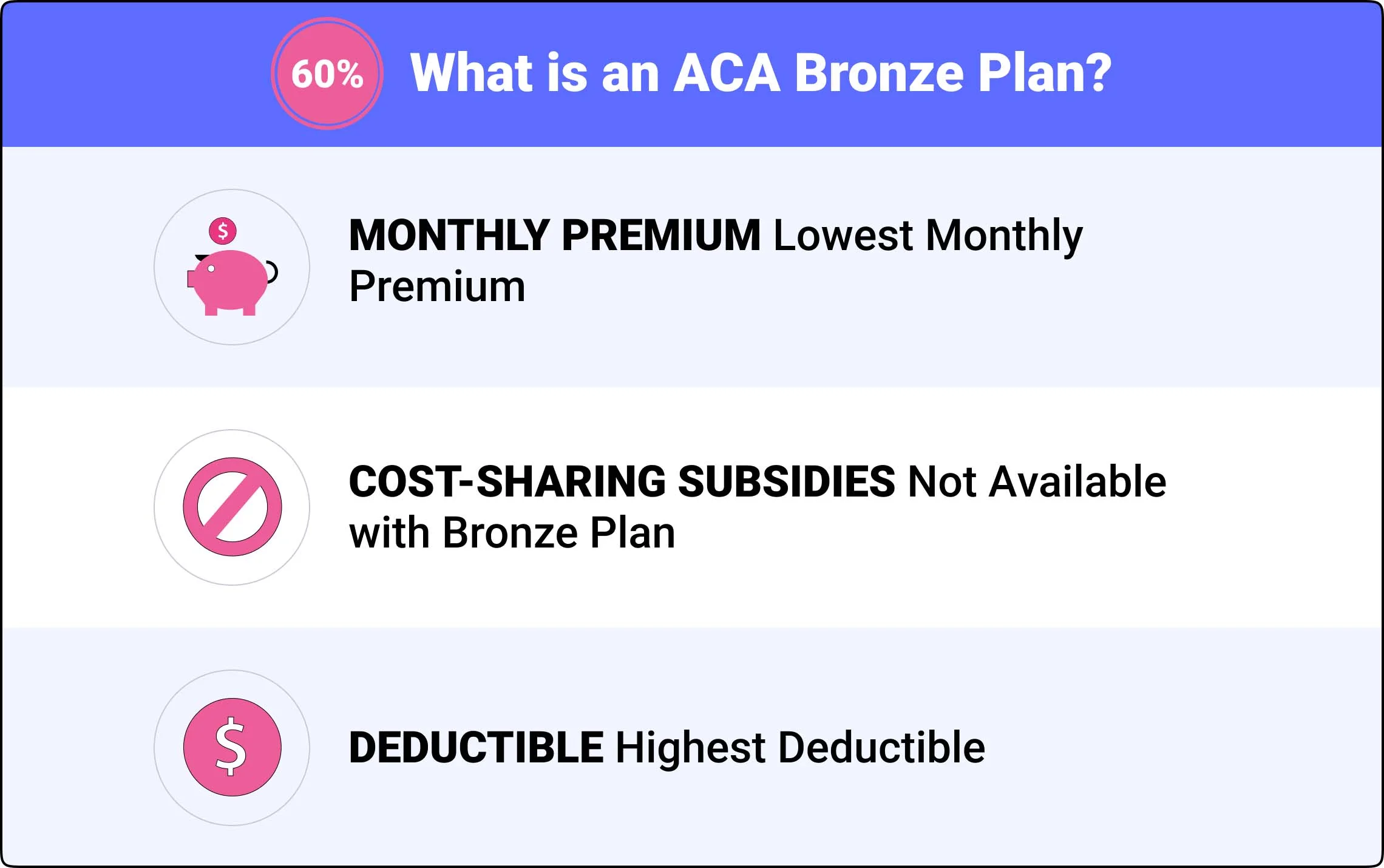

ACA Bronze Plans are a category of health insurance plans available under the Affordable Care Act (ACA). These plans are designed to provide essential healthcare coverage at a lower premium cost than other metal tiers like Silver or Gold.

Bronze Plans typically have higher deductibles and out-of-pocket costs,and they offer comprehensive coverage for essential health benefits. They’re especially significant for individuals and families who are relatively healthy and seek a balance between affordability and essential healthcare coverage.

Coverage and benefits

ACA Bronze Plans provide a comprehensive range of coverage and benefits, ensuring access to essential healthcare services. While the specific coverage details may vary depending on the insurance provider and state regulations, Bronze Plans typically include benefits such as preventive care, hospitalization, prescription drugs, and outpatient services. It’s important to review the plan details and summary of benefits to understand the specific services covered and any limitations or exclusions that may apply.

Cost sharing

Bronze Plans involve a certain level of cost sharing, meaning you will be responsible for paying some healthcare costs. This includes deductibles, the amount you must pay before the insurance coverage kicks in, and copayments or coinsurance for various services.

While Bronze Plans have lower monthly premiums, it’s essential to consider the potential higher out-of-pocket expenses when utilizing healthcare services. Understanding the cost-sharing structure of Bronze Plans will help you budget and plan for your healthcare needs effectively.

State-Specific ACA plans and resources

When exploring ACA Bronze Plans, navigating the state-specific ACA Marketplaces and tapping into the available resources is essential. Each state has its own marketplace, offering a tailored selection of healthcare plans and enrollment options. Visit our state pages below to find information in your area.

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas ACA Marketplace

Utah

Vermont

Virginia

Washington

Washington DC

West Virginia

Wisconsin

Wyoming

How to Enroll in a Bronze ACA Plan

Enrolling in a Bronze ACA Plan is a straightforward process that can be completed through the ACA Marketplace. To get started, visit the marketplace website for your state and create an account. Then, you can browse the available Bronze Plans, compare their features, and choose the one that best suits your needs and budget.

It’s important to note that there is an annual open enrollment period during which you can sign up for coverage. Additionally, certain qualifying life events, such as losing other healthcare coverage or changing family status, may qualify you for a Special Enrollment Period, allowing you to enroll outside the regular Open Enrollment Period. Be sure to review the specific enrollment dates and any special circumstances that may apply to ensure you get all the coverage you need.

Compare Bronze ACA plans in your area

Ready to explore and compare the rates of Bronze Plans available in your area? Click here to access our online rate form and find the best options tailored to your needs and budget. Take advantage of the opportunity to secure affordable healthcare coverage through ACA Bronze Plans. Compare rates now and make an informed decision for your healthcare needs.

Related Content

- ACA Silver Plans by State

- ACA Gold Plans by State

- ACA Platinum Plans by State

- Affordable Care Act Open Enrollment Guide for 2023

- 2023 Update on Open Enrollment for Health Insurance by State

- The Relationship Between State Politics and ACA Enrollment

- ACA Open Enrollment Period 2024: Find the Best Health Insurance

- ACA Income Limits Explained (2023)

- ACA Prescription Drug Coverage: Understanding Your Options