UPDATED: SEPTEMBER 06, 2023 | 1 MIN READ

ACA Silver Plans are designed to balance cost and coverage, making them an excellent choice for individuals and families looking to protect their health and financial well-being. In this article, we’ll discuss the intricacies of ACA Silver Plans.

Understanding ACA Silver Plans

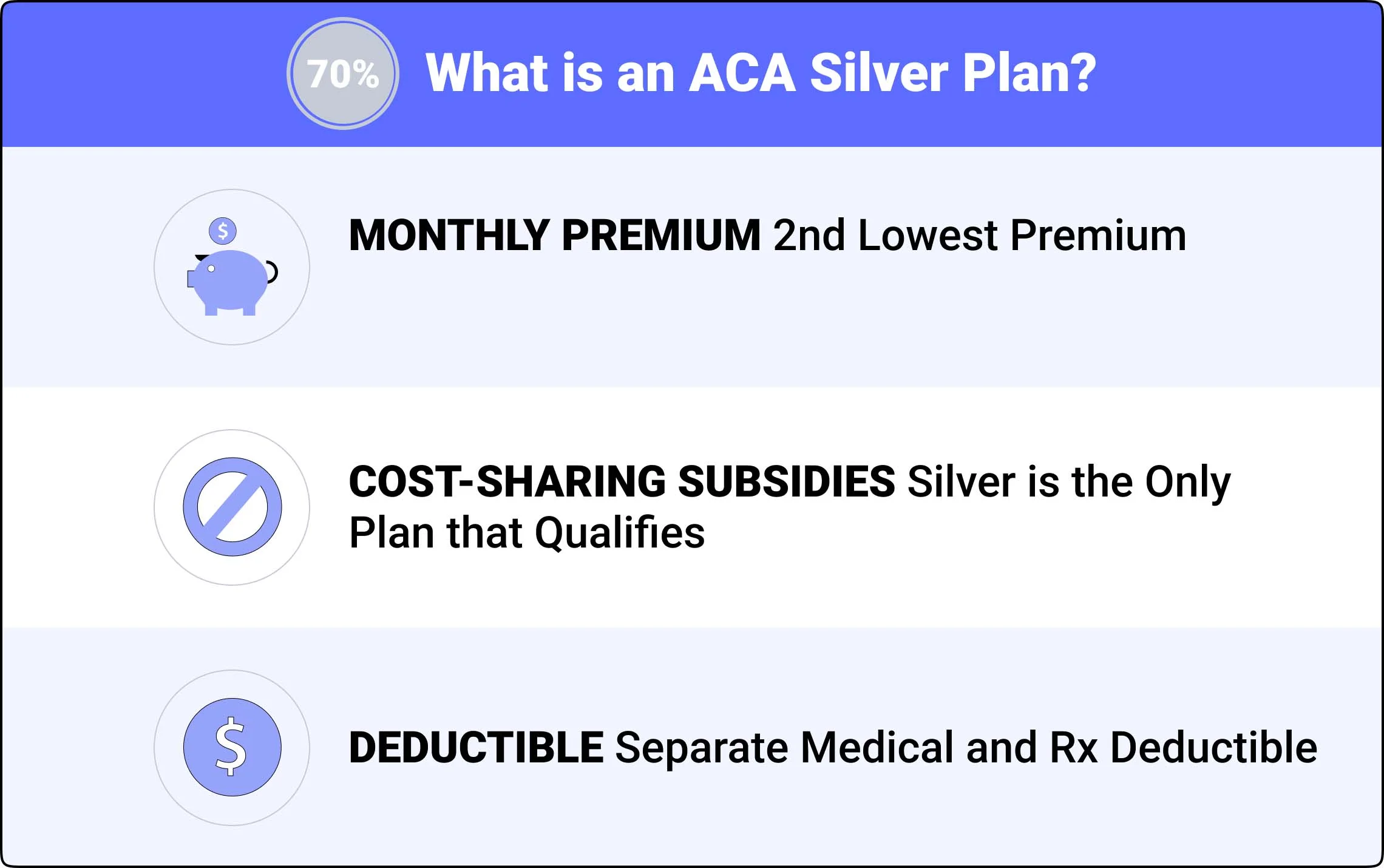

The key differentiator of Silver Plans is their cost-sharing structure, where the insurance company generally covers approximately 70% of healthcare costs on average. In comparison, the policyholder is responsible for the remaining 30%. This division makes Silver Plans an attractive option for those requiring moderate medical services but still want peace of mind with substantial coverage.

The level of financial assistance and premium tax credits available for ACA Silver Plans depends on an individual or family’s income and household size. Subsidies can significantly reduce monthly premiums, making Silver Plans an even more affordable choice for those who qualify. Moreover, ACA Silver Plans must cover essential health benefits, including preventive services, hospitalizations, prescription drugs, and more, ensuring policyholders have access to necessary medical services.

What is an ACA Silver plan?

An ACA Silver Plan is a type of health insurance policy available through the Health Insurance Marketplace, established by the Affordable Care Act (ACA). As part of the “metal tier” plans, Silver Plans offer a balanced approach between premium costs and coverage benefits.

One of the key advantages of ACA Silver Plans is the availability of premium tax credits and subsidies, which can significantly lower the monthly premium costs for eligible individuals. The amount of financial assistance is based on household income and size.

These subsidies make ACA Silver Plans more affordable, empowering more people to access quality health insurance coverage. Additionally, Silver Plans must adhere to essential health benefits requirements, ensuring that policyholders receive vital services such as preventive care, prescription drugs, and hospitalization coverage.

Coverage and benefits

These plans cover various medical services, including hospital stays, emergency care, prescription drugs, and preventive services. With approximately 70% of healthcare costs covered by the insurance company on average, Silver Plans offer substantial financial protection for individuals and families.

Policyholders can access regular check-ups, screenings, and vaccinations without additional costs, promoting preventive care and early detection of potential health issues.

Cost-sharing

ACA Silver Plans employ a cost-sharing structure that balances premiums and out-of-pocket expenses. Policyholders cover approximately 30% of their healthcare costs, while the insurance company shoulders the remaining 70% on average. This cost-sharing mechanism enables individuals to enjoy more affordable monthly premiums while benefiting from substantial coverage.

Additionally, those who qualify for premium tax credits and subsidies can further reduce their out-of-pocket expenses, making ACA Silver Plans even more accessible to a broader range of individuals and families.

State-Specific ACA Marketplace and Resources

To make the most of your ACA Silver Plans exploration, navigating the state-specific ACA resources can help. Each state operates its own Marketplace, providing a personalized array of healthcare plans and enrollment choices. Discover valuable information for your area by visiting our state pages below.

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas ACA Marketplace

Utah

Vermont

Virginia

Washington

Washington DC

West Virginia

Wisconsin

Wyoming

How to Enroll in a Silver ACA Plan

Enrolling in an ACA Silver Plan is a simple process facilitated through the ACA Marketplace. To begin, find an insurance agent to help narrow the options based on your needs. You can also review plans online through the ACA Marketplace website for your state.

Remember that there is an annual Open Enrollment Period during which you can sign up for coverage. However, certain qualifying life events, like losing other healthcare coverage or experiencing changes in family status, may qualify you for a Special Enrollment Period, allowing enrollment outside the regular Open Enrollment Period. Reviewing specific enrollment dates and special circumstances is essential to ensure you access all the necessary coverage for your unique situation.

Compare Silver ACA plans in your area

Ready to find the perfect ACA Silver Plan for you? Take control of your healthcare coverage today by comparing Silver ACA plans. Discover affordable options with comprehensive benefits tailored to your needs. Don’t miss out on the chance to secure your health and financial well-being.

Related Content

- ACA Bronze Plans by State

- ACA Gold Plans by State

- ACA Platinum Plans by State

- Affordable Care Act Open Enrollment Guide for 2023

- 2023 Update on Open Enrollment for Health Insurance by State

- The Relationship Between State Politics and ACA Enrollment

- ACA Open Enrollment Period 2024: Find the Best Health Insurance

- ACA Income Limits Explained (2023)

- ACA Prescription Drug Coverage: Understanding Your Options